Banks, for example, want to know before extending credit whether a company is collecting—or getting paid—for its accounts receivables in a timely manner. On the other hand, on-time payment of the company’s payables is important as well. Both the current and quick ratios help with the analysis of a company’s financial solvency and management of its current liabilities. It’s important to have a payroll policy that outlines how payroll advances will work in your business. This will give you and your employees clarity around the process and make it easier for everyone involved.

What is a payroll advance?

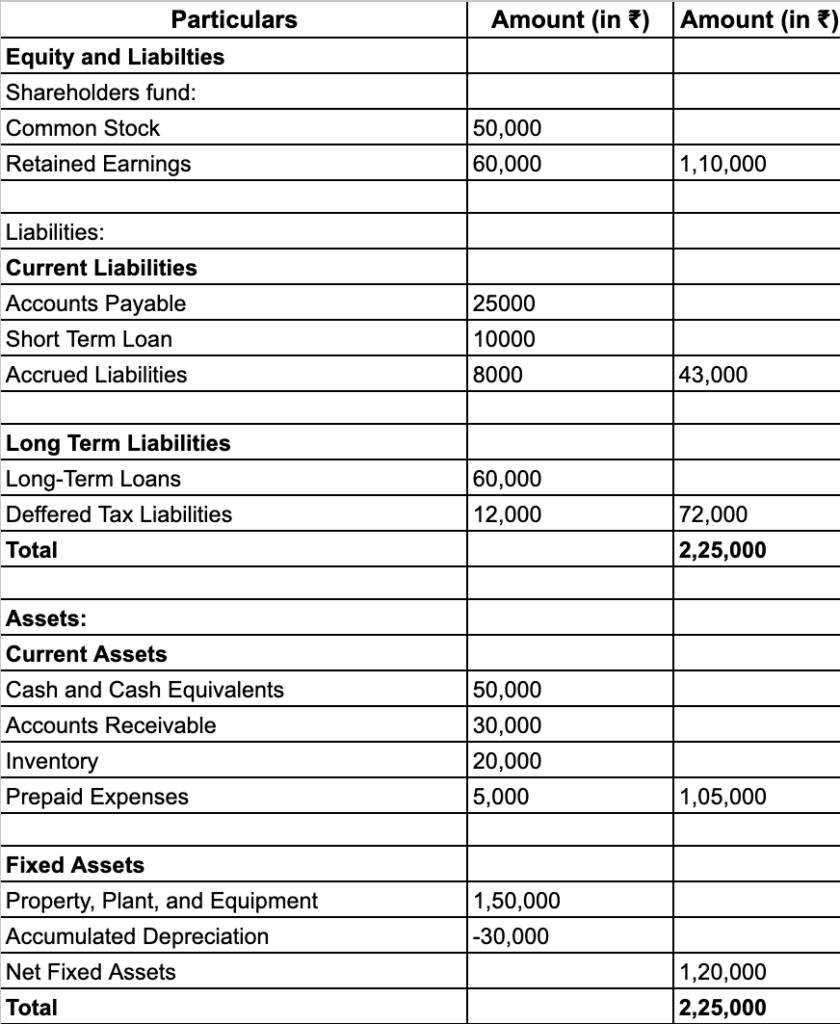

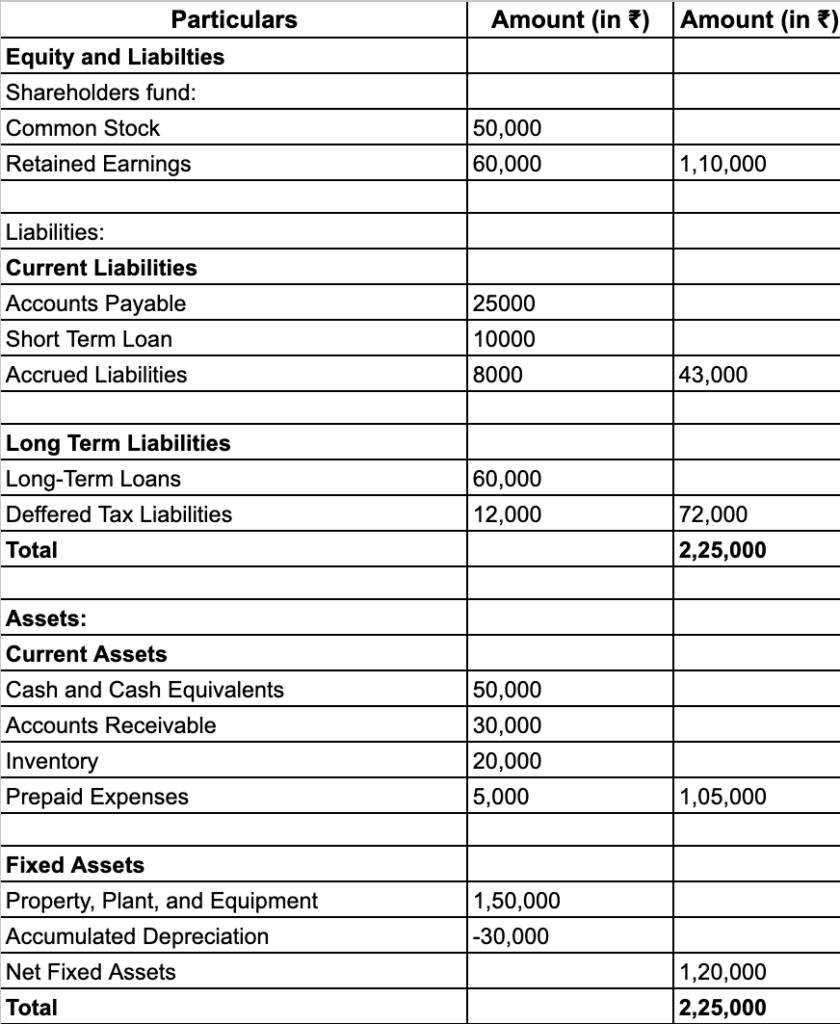

It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed. Current liabilities are typically settled using current assets, which are assets that are used up within one year. These cash advances are short-term loans for all intents and purposes. They meet the need for emergency cash without locking employees into high-interest loans offered by online and retail lenders.

Double Entry Bookkeeping

For the check or expense spent on employee, I categorized it under the new Repayment account for that employee- now it shows a balance for that account in chart of accounts. The account where the advance payment was deducted should also be the account where the repayment is posted, jessheegard. That should automatically have the deduction item on the employee paycheck on the next payroll schedule. It says that we are to determine the fair value of the loan using the market rate of a similar loan.

What is the entry when a company lends money to an employee?

- Please let me know how it goes or if you have any follow-up questions about payroll.

- The example above complies with International Financial Reporting Standards (IFRS), which companies outside the United States follow.

- The best option to give your employee an advance is to handwrite them a check.

- Do not trust your employee handbook even if it states that the final paycheck will have deductions for payroll advances.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Steffany, a sales representative at Lunar Gene Pharmaceuticals, is scheduled to attend a conference in California.

Create An Employee Advance

On a Monday morning, Sara, one of his employees, approaches him, requesting an advance.The employee is not charged interest, so essentially he is simply receiving part of his paycheck early. To avoid any of the possible pitfalls of a cash advance program, it is important for employers to take proactive steps in educating employees on the benefits and dangers of a cash advance. Payroll advances can be a lifesaver for an employee employee advances on balance sheet who runs into financial trouble. But without clear guidelines in place, they can also be easily abused, with employers paying the price. If an employee is unable to pay back to the advance on one paycheck, you can use QuickBooks Desktop reports to track the outstanding advance/loan balance. Enter the dollar amount from the cash advance in the Rate column.Additionally, the platform provides HR resources at no extra cost.

Tax Implications of Advances

Accurate recording of advances not only benefits the employer, but also safeguards employee rights. It creates a transparent system where both parties are protected. Additionally, cross-border employment situations can introduce issues related to currency exchange rates and international banking regulations.

On-demand pay is another great option for employees looking for an advance on their pay. On-demand pay lets employees access the wages they’ve already earned instead of waiting for their scheduled paycheck. For example, if your employees get paid on the 28th of every month, they can access their pay on the 15th for all the hours they worked from the start of the pay period until the 15th. This is a less risky way to advance payroll because employees access the wages they’ve already earned just a little earlier than originally planned. Offering on-demand pay is also a great way to improve your pay experience and increase employee happiness.

When the company pays its balance due to suppliers, it debits accounts payable and credits cash for $10 million. An Advance to Employee is a short-term loan an employer gives their employee to help them meet urgent personal or professional financial needs. These loans are extended with the expectation that they will be repaid within a set timeframe.

Any variances between the recorded balance and actual payments need to be investigated and resolved to maintain the integrity of the financial statements. Thus, if you change the employee status instead of deleting it on QuickBooks, the profile and pay records remain in your accounting database without any data loss in your tax payments. In most cases, the company records such advances in the payroll advance account or other receivables account, while making a deduction to the cash account. In some cases, the employee may want to pay back the amount of advance in installments rather than in full at the end of the month. The process of repaying advances is a straightforward yet important aspect of the financial relationship between an employer and an employee. When an advance is issued, the terms of repayment are typically outlined in a repayment agreement.

A business provides a cash advance to an employee part way through a month for 300. The amount is to be repaid at the end of the month when the employee receives payment of their wages for the month. If the cash advance is repaid through payroll withholdings, the amount withheld will be recorded as a credit to Advance to Employees. Instead, calculate taxes when you deduct the repayment amounts from the employee’s wages. I could just deduct an amount for the advance from a paycheck and have it mapped to the current asset account named employee advances.

The transaction needs to be put into the company’s financial system. For employees, the tax treatment of an advance depends on whether the advance is considered a loan or compensation. If the advance is structured as a bona fide loan with a formal agreement and expectation of repayment, it is not taxable to the employee at the time of receipt.